What is the Difference Between Prepaids & Accruals Expenses?

Whether you are a finance student or have simply developed an interest to manage your accounts in business, it becomes crucial to understand the prepaid expenses and accrued expenses are the technical jargons that define the company’s Balance sheet.

It becomes crucial to realize the difference between these expenses on the basis of:

- The timing of the expenses incurred

- The financial statements of a company

One can be easily be confused between prepaid expense vs accrued expense.

Hence the difference needs to be highlighted in detail, to avoid confusion in the balance sheet of your company.

Prepaid Expenses

These expenses are expenses incurred because of payments that have been made in advance. Though expenses are usually recorded as a liability in the balance sheet but these expenses are a slight deviation from the theory because the privileges can be incurred in the future.

An example of prepaid expense is an insurance premium. Though insurance payment is an expense but however the prime reason for undertaking insurance coverage is to receive future benefits from this expense.

These expenses are always recorded in the current asset of the balance sheet. Therefore when the insurance premium is paid in full at the beginning of the insurance coverage, the prepaid expense account for insurance is debited and the cash account is credited in the balance sheet.

However, at the end of every quarterly Balance Sheet, it is important that the prepaid expense account for insurance is credited and the insurance expense account is debited.

Other examples of prepaid expenses include advance payment of rent, supply orders in stock, tax paid in advance by corporations prior to payment of the actual tax liability.

How to record Accrued expense?

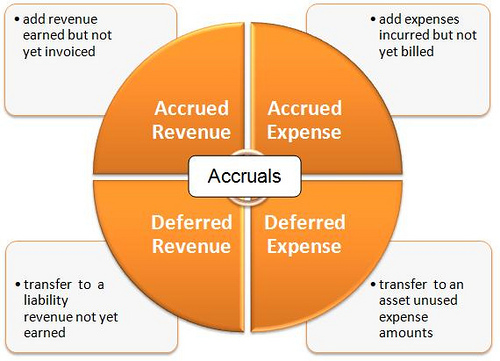

Accrued Expenses

The accrued expense is the exact opposite of prepaid expense. Where prepaid expenses are included in the current asset, accrued expenses are included in the current liability. Accrued expenses are expenses that have been incurred but the payment has not been made yet. Read more...

Post Your Ad Here

Comments