How to Build an App Like Splitwise for Easy Expense Sharing

The rise of shared financial responsibilities in modern relationships, friendships, and group activities has fueled the demand for apps like Splitwise, designed to simplify expense sharing. Whether managing a group trip, splitting bills with roommates, or keeping track of shared expenses among friends, apps like Splitwise have streamlined and automated expense management, reducing the hassle of manual calculations and helping maintain financial harmony. Building an app similar to Splitwise can be rewarding as a business opportunity and a solution for improving shared expense tracking. This guide covers essential steps, features, technology choices, and costs in creating an expense-sharing app.

1. Understanding Splitwise and Its Core Features

Splitwise stands out for its intuitive interface, user-friendly features, and ease of handling shared expenses. Understanding its main features, which contribute to its functionality and popularity, is essential to building an app like Splitwise.

Core Features of Splitwise:

- Expense Tracking: Users can log expenses and categorize them for easy reference.

- Expense Splitting: Splitwise allows flexible splitting options, including equal, percentage-based, or customized splitting.

- Automated Calculations: The app automatically calculates how much each person owes.

- Real-Time Notifications: Users are notified when expenses are added or settled.

- Payment Integration: Splitwise integrates with payment solutions like PayPal, Venmo, and bank transfers for quick settlements.

- Reporting and Analytics: Users get detailed insights into their spending, making it easier to track shared expenses over time.

These features ensure transparency, reduce manual calculations, and make expense management a seamless experience. A similar app should incorporate these functionalities while considering additional features for differentiation.

2. Define the Unique Selling Points (USPs) for Your App

Differentiating your app from Splitwise is crucial for capturing user interest in a competitive market. Consider offering unique features that could add value for users. Here are some suggestions:

- Integration with Multiple Currencies: Ideal for global users or frequent travelers, enabling currency conversions on expenses.

- AI-Powered Expense Suggestions: Recommend splitting options or notify users of overdue payments using AI.

- Offline Functionality: Allow users to access the app and add expenses even without an internet connection.

- Gamification Elements: Adding rewards or badges for timely settlements or low expenses could make the app engaging.

- Voice-Based Entry: Enable expense addition through voice commands for convenience.

Determining your app’s USPs based on user needs and industry trends will create an appealing product that attracts and retains users.

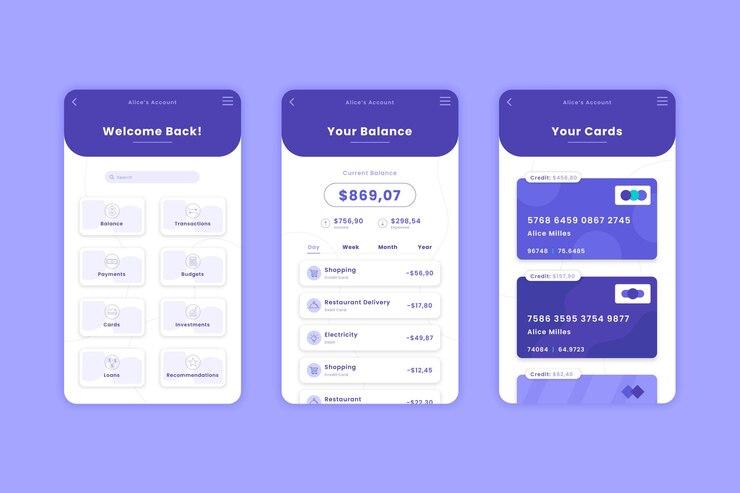

3. Determine Key Functional Requirements and User Flow

Developing an expense-sharing app involves planning each feature, deciding on user flows, and outlining how users interact with the app.

Basic User Flow:

- User Registration/Login: Sign-up via email or social media.

- Dashboard: An overview of outstanding balances and recent activity.

- Add Expense: Ability to add expenses and choose split preferences.

- Expense Overview: A list of current shared expenses.

- Payment Settlement: Integrated payment options for settling dues.

- Notifications and Reminders: Alerts for new expenses or payment deadlines.

This flow creates a seamless experience for users, ensuring ease of use and minimizing unnecessary steps.

4. Choose the Right Tech Stack for Development

The choice of technology stack depends on factors like app complexity, scalability needs, and platform (iOS, Android, or both). Here’s a typical tech stack for building a Splitwise-like app:

- Frontend Development: Use frameworks like React Native or Flutter to create cross-platform apps. These frameworks save time and resources while offering smooth user experiences.

- Backend Development: For the backend, Node.js or Django with Python are popular choices. These technologies offer scalability, robust data handling, and compatibility with multiple databases.

- Database: MongoDB or PostgreSQL are reliable options for storing user data, expenses, and transaction records.

- Real-Time Notification Service: Firebase Cloud Messaging or OneSignal can provide push notifications, ensuring users are updated on recent transactions.

- Payment Integration: Stripe and PayPal SDKs are commonly used for secure payment integration, while regional payment options may also be included based on user demographics.

- AI and Machine Learning (ML): Incorporating TensorFlow or scikit-learn for AI/ML capabilities can improve personalization and enhance user engagement with expense insights and recommendations.

5. Prioritize Essential Security and Privacy Features

Since financial data is sensitive, securing user information is vital in expense-sharing apps. Here are essential security practices to follow:

- Data Encryption: Encrypt all user data, including transactions, login details, and payment information, to prevent data leaks.

- Authentication and Authorization: Implement secure login protocols with options for multi-factor authentication.

- Secure Payment Gateway: Use PCI-DSS-compliant payment processors like Stripe and PayPal to ensure financial transactions are safe.

- GDPR Compliance: Follow data privacy laws and standards to ensure user data is handled securely.

Incorporating these security features will build user trust and prevent data breaches.

6. Design an Intuitive and User-Friendly Interface

User experience (UX) and user interface (UI) design are crucial to the success of an expense-sharing app. The design should be minimalistic, intuitive, and easy to navigate. Here are some design principles to follow:

- Simplicity: Keep screens uncluttered, with easily accessible options for adding expenses, viewing balances, and paying dues.

- Consistency: Use a consistent design across the app to ensure users don’t get lost or confused.

- Customizable Themes: Offering light and dark modes and customizable color schemes can enhance user satisfaction.

- Visual Appeal: Use visually appealing icons, fonts, and color schemes that align with the app’s brand and user demographics.

A well-designed app fosters user satisfaction and ensures retention.

7. Estimate the Cost of Building an Expense Sharing App

The development cost of an expense-sharing app depends on various factors, including feature complexity, platform choice, and development team rates. Below is an approximate breakdown:

| Component | Estimated Cost (USD) |

|---|---|

| Design and UI/UX | $8,000 - $15,000 |

| Frontend Development | $15,000 - $25,000 |

| Backend Development | $20,000 - $35,000 |

| Database & Hosting | $5,000 - $10,000 |

| Payment Integration | $3,000 - $7,000 |

| Testing and QA | $5,000 - $10,000 |

| Maintenance | $2,000 - $5,000 per month |

Depending on the complexity and quality of the app, total costs can range between $60,000 and $100,000.

Conclusion

Creating an app like Splitwise can be a profitable venture, meeting the increasing need for streamlined expense management among groups. You can develop a competitive app that simplifies shared financial responsibilities by focusing on core features like expense tracking, flexible splitting, and secure payment integration, along with innovative additions like AI suggestions and currency conversions. Prioritize security and a user-friendly interface to ensure users find the app safe and easy to use. With careful planning, a strong tech stack, and attention to unique user needs, your expense-sharing app can find its place in the market and foster a loyal user base.

FAQs

Q1: How long does it take to develop an expense-sharing app like Splitwise?

A1: Developing an app like Splitwise can take approximately 4 to 8 months, depending on the complexity of the features, the platform, and the development team's size.

Q2: How does an expense-sharing app make money?

A2: Revenue can be generated through premium subscriptions offering advanced features, in-app advertisements, partnerships, or transaction fees on integrated payment gateways.

Q3: Is it necessary to build both iOS and Android versions initially?

A3: Not necessarily. Many startups begin with one platform to test the app's viability, typically iOS or Android, and expand to the other once the app gains traction.

Q4: What are some additional features that could enhance an expense-sharing app?

A4: Consider adding split options for recurring expenses, travel and budgeting tools, or AI-driven financial insights for enhanced usability.

Q5: Can I integrate multiple payment methods in the app?

A5: Yes, integrating multiple payment options like credit cards, digital wallets, and bank transfers enhances convenience for users and widens the app's appeal globally.

Comments