May We Live in Interesting Times

A few questions arise as investors and business executives reflect on the recent events, which include global conflicts, a pandemic, skyrocketing inflation, and technology upheavals, among others:

1. Do we really live in "interesting" times, or are we only observing the typical ups and downs in the economy and society?

2. How will the upcoming decade differ from the previous decade for investors and executives?

3. Is this the moment for the S5C, or sub-$5 billion industrial businesses, to take center stage?

4. How do these businesses take advantage of the potential if this is the right time for the S5C?

5. The responses to these queries indicate that there are a lot of prospects in the Industrial sector for investors and executives of companies.

Interesting but Not Exceptional Times

Exhibit 2

Indeed, these are fascinating times, but the past was fascinating as well. We have always been residing in an exciting period of time.

The Next Decade

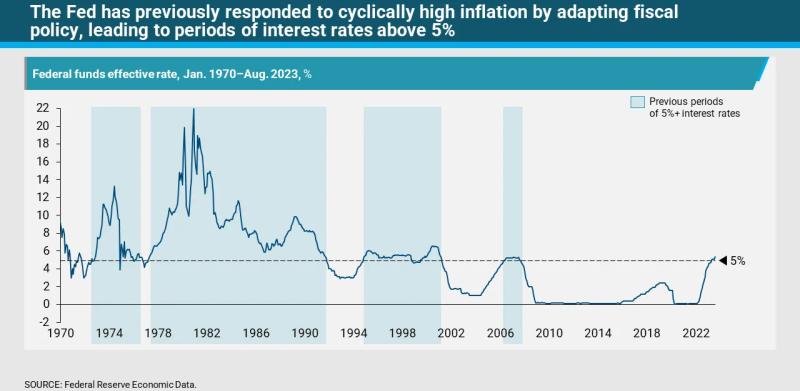

The compelling elements of our era have changed in ways that could influence investors' choices in the years to come. Interest rate changes are particularly important.

Macroeconomic fundamentals during the last ten years have included the money supply more than tripling and the cost of capital being close to zero thanks to low interest rates. This made speculative purchases more alluring during the stock market bull market. Since all rates were low, there was no market penalty for risk because the premium on risky assets was equivalent to the premium on risk-free assets. In this environment, comparatively riskier IT industry initiatives could draw significant funding for growth. The eight biggest firms, primarily tech heavyweights, saw their market caps surge (Exhibit 3).

Exhibit 3

Currently, the yield curve is inverted and interest rates have increased to 5% or more. Despite slowing, inflation is still higher than the Fed's target of 2%. Investors will experience a fundamental shift as a result: the market no longer rewards risk-taking because to the availability of several low-risk options that yield returns comparable to those of greater risk investments. Investors are moving away from the riskiest investments in this scenario, and the market winners of the previous ten years underperformed in 2022 (Exhibit 4).

Exhibit 4

It's Time to Shine for Sub-$5B Industrials

We refer to the group of industrial enterprises with market capitalization under $5 billion as the Industrial Sub–$5 Billion Cohort (S5C), as these improvements appear likely to benefit these companies. Collectively, these businesses exceeded their US market counterparts valued at less than $5 billion in terms of revenue growth and profitability gain between 2012 and 2022 (Exhibit 5). Moreover, investors have a plethora of intriguing prospects due to the sheer volume of companies in the Industrial S5C category.

Exhibit 5

The Industrial S5C is appealing because it offers large returns at a comparatively low risk. The category's low risk is a result of its excellent operational performance, robust balance sheets, and appealing industry structure. The chance to learn from "Trailblazers," or businesses that have effectively increased investor returns over the past ten years, makes higher returns conceivable (Exhibit 6).

Exhibit 6

Looking closely into the Industrial S5C to identify businesses that are either cheap or poised to profit from riding today's tailwinds would be part of an investor's strategy for "making hay" in the upcoming years. Generally speaking, these are typically businesses with a narrow portfolio (Exhibit 7). Additionally, the Trailblazer businesses can demonstrate what an involved investor would look for and support, just as they can serve as models for management.

Exhibit 7

Putting these concepts into practice requires striking a balance between investors' desire to make quick profits and growth goals. A spin-out/spin-in partnership is one type of business model that can accomplish this balance (Exhibit 8). This strategy involves a company that maintains its primary business while spinning out a growth business or businesses through a partnership agreement wherein the parent company owns a minority stake and may concentrate more on its core business day-to-day. Under the direction of a capability partner, the partner holding the majority stake manages the new organization.

Exhibit 8

The times we operate in are exciting for investors and executives alike. The current climate is intriguing in a positive sense, with significant upside potential, for well-managed industrial companies with market capitalization under $5 billion. Recognizing which levers to pull to maximize current opportunities would benefit investors and company executives.

View Source:- https://www.ayna.ai/publication/may-we-live-in-interesting-times

Post Your Ad Here

Comments