Chasing Value In Industrial Conglomerates

Conglomerates make up one in six of the major industrial enterprises, and they often create less value than more specialized businesses. Value multiplication is more common among conglomerates that satisfy four requirements.

Conglomerates make up around one in six sizable publicly traded industrial enterprises. How have the last ten years been for industrial conglomerates? What sets apart the most successful corporations from the others?

We examined the financial results of industrial conglomerates in order to provide answers to these queries, and we came to the following important conclusions.

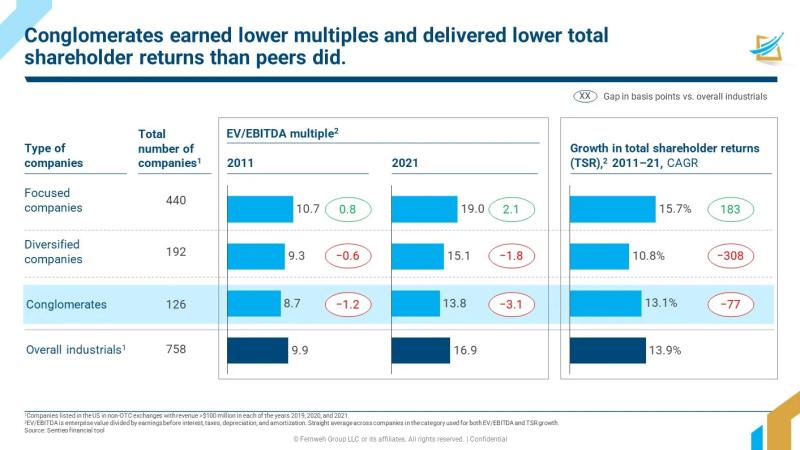

In the past ten years, industrial conglomerates have underperformed their peers in terms of revenue growth, earnings before interest, taxes, depreciation, and amortization (EBITDA), and free cash flow (FCF) margin expansions. However, their financial performance has been less volatile than that of other industrial companies (Exhibit 1). Conglomerates produced lower overall shareholder returns and lower multiples than peers, earning low multiples in relation to the sum of their parts.

Exhibit 1

Within the three types of organizations under investigation—focused, diversified, and conglomerate—performance varied considerably. All significant financial measures, such as the rise in total shareholder returns (TSR), revenue growth, and EBITDA margin expansion, were outperformed by companies in the top quartile compared to those in the bottom quartile.

Value multipliers, or top-performing conglomerates, outperformed boat anchors, or poorest performers, in terms of TSR growth, with a difference of 1,510 basis points (Exhibit 2). There was either minimal or no "conglomerate discount" applied to value multipliers.

Exhibit 2

Multiplying value is linked to four factors: effective capital allocation, a strong performance culture, outstanding portfolio management, including divestments, and the capacity to take advantage of the company's scale.

Strategic and well-managed divestitures generate value. There are two options for conglomerates aiming to generate value through divestitures: carve-outs or spin-offs/split-offs. Majority carve-outs have been the most common type of divestment in recent times, and they have produced larger profits for the parent (Exhibit 3). In majority carve-outs, the parent has benefited more from divestitures involving strategic or operational partners than from those involving a financial buyer.

Exhibit 3

Our research concludes that conglomerates can be successful value creators, but doing so calls for a focused strategy to steer clear of typical flaws and take advantage of structural advantages (e.g., lower volatility, bigger scale, cross company synergies). Developing the ability to create value also means learning how to acquire and, when required, sell companies that have the potential to generate greater value outside of the company.

Advertise on APSense

This advertising space is available.

Post Your Ad Here

Post Your Ad Here

Comments