The complete Guide to Developing a Mobile Banking software App

What Is Banking Software?

The banking industry provides monetary services to its

customers. The repertoire of services of the banking industry includes -

·

Receipt and holding of

customers' money in different types of bank accounts.

·

Payment of cheques and

debit transactions of customers.

·

Provision of financing and

loans.

·

Management of trade

finance, foreign exchange, corporate banking, treasury services, and wealth

management.

·

Dealing in a wide array of

financial products such as credit cards, equity trading accounts, etc.

Developing a mobile app for any industry is a serious

undertaking, but in banking, it can be especially challenging because of the

need to consider so many different technologies. Cybersecurity, online payment

solutions, authentication, UX/UI and many other elements must integrate

seamlessly for a banking app to be both functional and competitive.

What does it take though, to hit the home run in banking app

development? How can you, as a decision-maker within a bank, ensure your app

performs precisely as per your expectations, and those of your customers?

Why Should You Build a Mobile Banking App?

The

main reason for developing a

mobile banking app is

competitiveness. An application stands out among numerous ordinary tools,

as it has turned into the most convenient and effective channel of interaction

with customers.

Today’s

consumer would rather choose a bank with a convenient website, Internet

banking, a user-friendly mobile application and speedy services; indicators

such as interests and deposit rates, or the place of a bank in some ratings,

are placed on the back burner. Hence, to win the loyalty of clients and remain

competitive, a bank should be mobile.

Some statistics to

prove the increasing popularity of banking apps:

·

Mobile banking users are

expected to exceed 1.75 billion by 2019, representing 32% of the global adult

population, according to Juniper research.

·

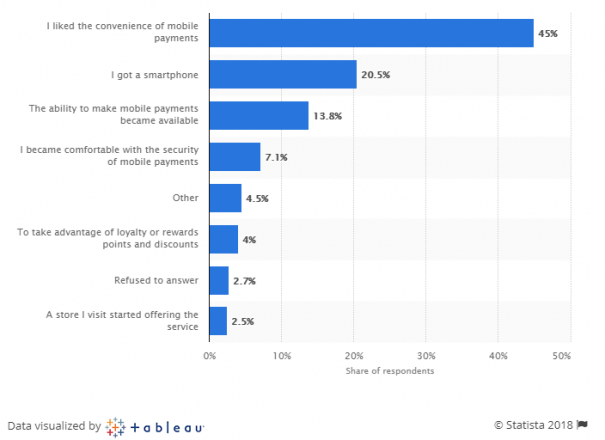

45% of respondents named

convenience the main reason they started using mobile payments, Statista found out.

·

·

As of June 2018, the

financial business is in the top of the most

popular Android app categories worldwide, taking 25.53% of the market share.

·

Statista also provided data

on the availability of the world’s leading payment providers Apple Pay,

Samsung Pay and Android Pay in global regional markets. It turned out that the

Asia-Pacific region has the highest number of total active markets across all

three payment systems.

What are the main reasons you started using mobile payments?

NCrypted

has deep knowledge of banking processes and expertise in implementing banking software app solutions. With our solution, you can be assured of providing the

best digital services to your customers.

Post Your Ad Here

Comments