Get Daily Prediction & Stocks Tips Online

Are you ready to navigate the dynamic world of stock markets

with confidence? Each day brings new opportunities and challenges, making it

crucial to stay informed about market trends. Understanding daily predictions

can be your secret weapon in making smart investment decisions. Whether you're

an experienced trader or just starting out, knowing what to expect from indices

like SENSEX, NIFTY, BANKNIFTY, and FINNIFTY is essential for maximizing your

gains.

Let’s dive into today’s market landscape and uncover

insights that could shape your trading strategies. Get ready for valuable tips

that will keep you ahead of the game!

Market Prediction for today

Today’s market prediction reflects a cautious optimism as

global factors come into play. Investors are closely monitoring economic

indicators and geopolitical developments that could sway trading patterns.

With the recent fluctuations in commodity prices, analysts

suggest volatility may persist. This means traders should be prepared for swift

movements in stock values throughout the day.

Sentiment among investors appears balanced, with some

leaning towards defensive stocks while others eye growth opportunities. The

opening bell might see mixed reactions as key earnings reports trickle in.

As midday approaches, keep an eye on trading volume; it

often signals broader market sentiment shifts. Staying informed about external

catalysts will also help you anticipate sudden changes in direction.

Keep your strategies flexible to adapt to real-time updates

and insights as the day unfolds!

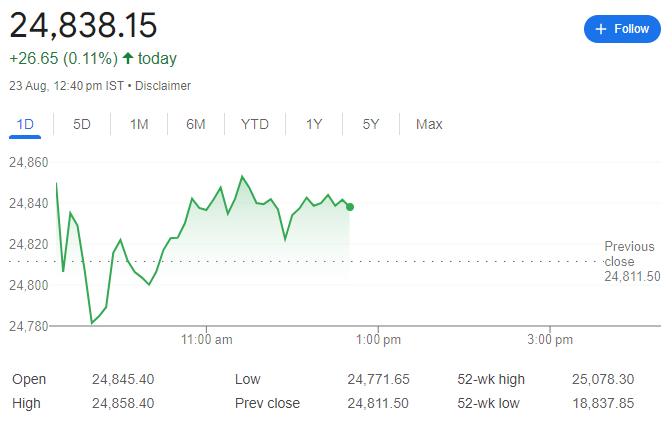

SENSEX Prediction for today

Today's SENSEX prediction reflects a cautious yet optimistic

market outlook. Analysts anticipate fluctuations driven by global cues and

domestic economic indicators.

Market sentiment appears to be influenced by recent

corporate earnings releases. Investors are keenly watching for any surprises

that could sway stock prices significantly.

Technical analysis suggests potential resistance levels

around the 65,000 mark. If breached, it may signal further upward momentum in

the short term.

On the flip side, geopolitical tensions and inflationary

pressures could lead to volatility throughout the trading session. Traders

should stay alert for news updates that might impact investor confidence.

Today's SENSEX movement will likely depend on both external

factors and local developments. Keeping an eye on these variables can help

investors make informed decisions as they navigate this dynamic landscape.

NIFTY Prediction for today

Today's NIFTY prediction indicates a cautious optimism in

the market. Analysts are closely watching key resistance levels around 18,500.

If the index can maintain above this threshold, we might see an upward trend.

On the flip side, strong support is anticipated near 18,300.

A drop below this level could trigger selling pressure and shake investor

confidence.

Market sentiment today is influenced by global cues and

domestic economic data. Traders should keep an eye on important announcements

that may sway trading volumes.

Additionally, sectors like IT and pharma show potential for

gains based on current trends. However, volatility remains a concern as

investors assess various factors impacting market dynamics throughout the day.

BANKNIFTY Prediction for today

Today's BANKNIFTY prediction reflects a cautious optimism.

Traders are closely monitoring key levels as the market reacts to global cues

and local economic indicators.

The index has shown resilience in recent sessions, bouncing

back from earlier corrections. Analysts suggest that if it maintains support

above 45,000 points, we might see bullish momentum building up throughout the

day.

On the other hand, any dip below this level could trigger

profit booking among investors. Watch for significant movements around

financial stocks, as they tend to influence BANKNIFTY's trajectory

significantly.

Market sentiment is mixed but largely positive due to

favorable earnings reports from major banks. Keep an eye on news related to

interest rates and inflation; these factors can sway investor confidence

dramatically.

As always, stay alert and consider your risk appetite before

making trading decisions today.

FINNIFTY Prediction for today

Today's FINNIFTY prediction indicates a cautious outlook.

Market participants are closely watching various economic indicators that could

influence financial stocks.

Analysts suggest that the index might experience slight

fluctuations throughout the day. Key resistance levels to monitor will be

around 19,800 points, while support is expected near 19,600 points.

Sentiment in the banking sector remains mixed due to recent

policy updates and global market cues. Traders should keep an eye on major

earnings reports slated for release today.

Watching how individual bank stocks perform can provide

crucial insights into overall FINNIFTY movement. Traders are advised to stay

informed and consider adjusting their strategies accordingly if volatility

increases during trading hours.

Stay updated with real-time data for better decision-making

as the day unfolds!

Faqs about market prediction

Q: What is the current value of the SENSEX?

A: The current value of the SENSEX is 79,596.

Q: What is the predicted trend of the SENSEX?

A: The predicted trend of the SENSEX is negative.

Q: What are the support levels for the SENSEX?

A: The support levels for the SENSEX are 79,760, 79,371, and

78,991.

Q: What are the resistance levels for the SENSEX?

A: The resistance levels for the SENSEX are 80,529, 80,909,

and 81,298.

Q: What is the tentative range for the SENSEX?

A: The tentative range for the SENSEX is 80,985 to 79,312.

Q: What is the accuracy of the SENSEX prediction?

A: The accuracy of the SENSEX prediction is 92%.

Q: What should I do if the SENSEX goes below 80,968?

A: If the SENSEX goes below 80,968, it is considered bearish

and you should consider going short.

Q: What is the stoploss for going short in the SENSEX?

A: The stoploss for going short in the SENSEX is 80,968.

Q: What should I do if the SENSEX goes above 80,985?

A: If the SENSEX goes above 80,985, it is considered bullish

and you should consider going long.

Q: What is the stoploss for going long in the SENSEX?

A: The stoploss for going long in the SENSEX is 79,312.

Q: What are the risks associated with investing in the

SENSEX?

A: There are always risks associated with investing in the

stock market. It is important to do your own research and consult with a

financial advisor before making any investment decisions.

Comments