How to Create a Custom Trading Platform — Step-by-step Guide

Creating a custom trading platform tailored to your specific needs can provide significant benefits. However, it is not easy to get custom trading software development services without the assistance of a development company that has experience in building something relevant. The only way to fix this common but critical issue is that you need to find a genuine development firm with a broad client base. In this blog, we will share a step-by-step guide on the development of a custom trading platform and the process involved in it.

Step-1. Define Your Requirements:

- Identify Goals: Clearly outline the objectives of your trading platform (e.g., improve efficiency, reduce costs, enhance risk management).

- Determine Features: Specify the essential features, such as order execution, market data, charting tools, and risk management features.

Step-2. Choose a Technology Stack:

- Frontend: Select a framework like React, Angular, or Vue.js for building the user interface.

- Backend: Choose a programming language and database (e.g., Node.js, Python, MySQL) for custom trading software development.

- Cloud Platform: Consider a cloud platform like AWS, Azure, or GCP for hosting and scalability.

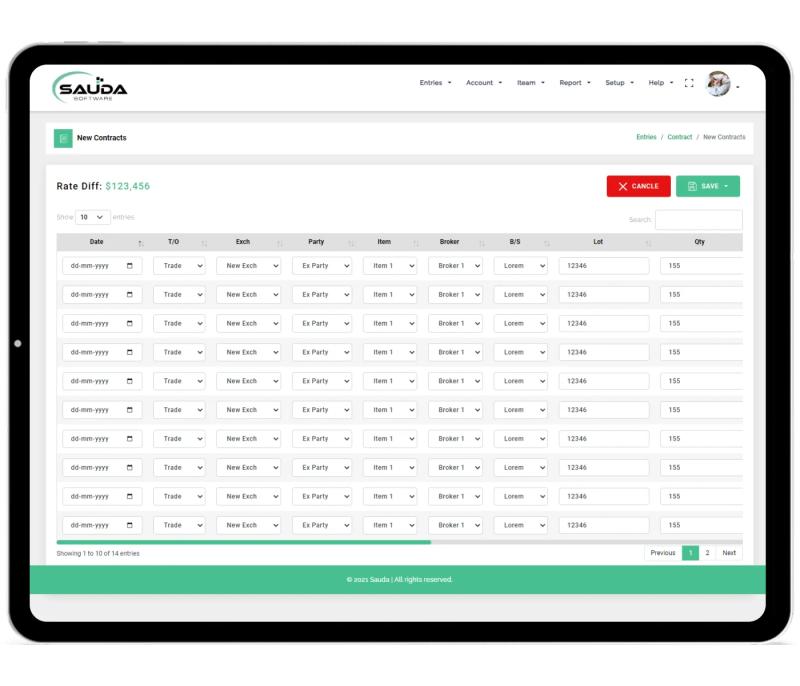

Step-3. Design the User Interface (UI) and User Experience (UX):

- Create a visually appealing and intuitive interface that is easy to navigate.

- Ensure a seamless user experience across different devices.

Step-4. Develop Core Features:

- Order Execution: Integrate with brokers or exchanges for order placement and execution.

- Market Data: Access real-time market data and historical data.

- Charting Tools: Provide advanced charting tools for technical analysis.

- Risk Management: Implement risk management features like stop-loss and take-profit orders.

Step-5. Integrate with Third-Party Services:

- News Feeds: Integrate with financial news providers with the assistance of trading platform development company.

- Social Media: Connect with social media platforms for community engagement.

- Payment Gateways: Integrate payment gateways for deposits and withdrawals.

Step-6. Testing and Optimization:

- Thorough Testing: Test the platform thoroughly to ensure it functions correctly and meets your requirements.

- Gather Feedback: Collect feedback from users and make necessary improvements.

Step-7. Security and Compliance:

- Data Protection: Implement robust security measures to protect sensitive data.

- Regulatory Compliance: Ensure compliance with relevant regulations (e.g., FINRA, SEC).

Step-8. Launch and Marketing:

- Launch: Deploy your platform to your target audience.

- Marketing: Promote your platform through targeted marketing campaigns.

By following these steps and working with a skilled development team, you can build a custom trading platform that meets your specific needs and provides a competitive advantage.

How to Choose a Company for Custom Trading Software Development?

Choosing the right company for custom trading software development is crucial for the success of your project. Here are some key factors to consider:

- Expertise and Experience:

- Industry Knowledge: Look for companies with experience in the financial industry and developing trading management system.

- Portfolio: Review their previous projects and case studies to assess their capabilities.

- Technology Stack: Ensure they have expertise in relevant technologies (e.g., Python, Java, C++).

- Development Process:

- Agile Methodology: Assess if they use agile methodologies for flexibility and adaptability.

- Communication: Evaluate their communication channels and responsiveness.

- Project Management: Understand their project management approach and tools.

- Quality and Standards:

- Code Quality: Inquire about their coding standards and quality assurance practices.

- Testing: Ask about their testing procedures and quality assurance processes.

- Security: Ensure they prioritize data security and compliance with regulations.

- Client Reviews and Testimonials:

- Feedback: Read reviews and testimonials from previous clients to gauge their satisfaction.

- Case Studies: Analyze case studies to understand their approach and results.

- Cost and Timeline:

- Budget: Compare pricing and payment terms.

- Timeline: Discuss their estimated timeline for project completion and potential delays.

- Location and Time Zone:

- Proximity: Consider the geographical location and time zone difference for effective communication.

- Cultural Differences: Evaluate if cultural differences might impact collaboration.

- Post-Development Support:

- Maintenance: Inquire about their ongoing maintenance and support services.

- Updates: Ask about their approach to updates and future platform versions.

By carefully evaluating these factors, you can choose a trading software development company that aligns with your project goals and delivers a high-quality product.

What is the Technology Required in Trading Management System Development?

The technology stack for trading management software development will depend on your specific requirements, budget, and the development team's expertise. However, here are some popular options:

Frontend Development:

- React: A popular JavaScript library for building user interfaces.

- Angular: Another popular JavaScript framework for creating dynamic web applications.

- Vue.js: A lightweight and flexible JavaScript framework.

Backend Development:

- Node.js: A JavaScript runtime environment for building server-side applications.

- Python: A versatile programming language for backend development.

- Ruby on Rails: A full-stack web development framework.

Database:

- MySQL: A popular open-source relational database management system.

- PostgreSQL: Another powerful relational database.

- MongoDB: A NoSQL database suitable for storing unstructured data.

Cloud Platform:

- AWS (Amazon Web Services): A comprehensive cloud platform with a wide range of services.

- Azure (Microsoft Azure): Another popular cloud platform with various offerings.

- GCP (Google Cloud Platform): A cloud platform from Google with a focus on scalability and flexibility.

Other Technologies:

- API Integration: Integrate with third-party APIs for market data, payment processing, and other functionalities.

- Real-time Data: Use technologies like WebSockets for real-time updates on market data and trade execution.

- Charting Libraries: Integrate charting libraries like Highcharts or Chart.js for visualizing market data.

- Security: Implement robust security measures to protect sensitive data with your digital business technology platform.

Additional Considerations:

- Scalability: Choose technologies that can handle increasing workloads as your trading platform grows.

- Performance: Ensure the technologies you select provide a fast and responsive user experience.

- Cost: Consider the cost of different technologies and their long-term implications.

Summary

If you carefully choose the appropriate technologies, you can build a trading management software solution that is efficient, scalable, and meets your specific requirements. The help of a custom software development company is needed if you wish to gain a competitive edge with the application and help you grow your business. If you wish to know about the best technology used in e commerce then you should consult with the experts at Dreamer Technoland for more assistance.

Comments