Nifty Bank: A Comprehensive Guide for Traders and Investors

Nifty Bank, also referred to as Bank Nifty, is one of the

most popular stock market indices in India. It consists of the 12 most liquid

and large capitalized banking stocks from the National Stock Exchange (NSE).

Understanding the Nifty Bank index is crucial for traders and investors who

want to take advantage of the banking sector's performance in the stock market.

What is Nifty Bank?

Nifty Bank was introduced by NSE to measure the performance

of the banking sector. This index tracks the stock performance of 12 major

banks in India, including both private and public sector banks. As of today,

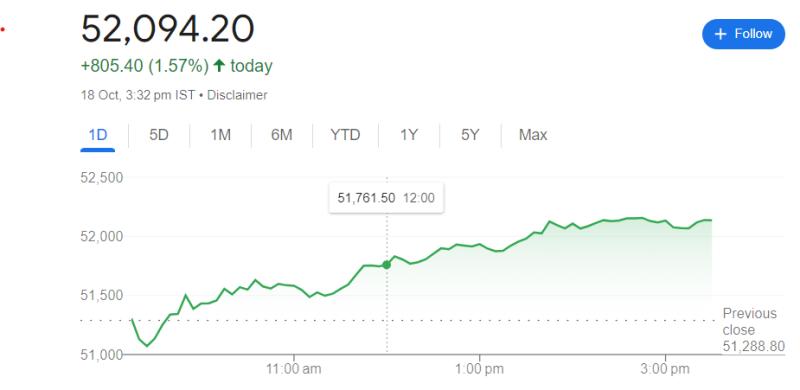

Bank Nifty stands at 52,094.

This index is widely traded in derivatives, such as Bank

Nifty futures and options, making it an attractive avenue for both day traders and

long-term investors.

Importance of Nifty

Bank

The banking sector is often considered a backbone of the

economy. Hence, Bank Nifty serves as an important indicator of market sentiment

in relation to the overall economic health of India. Investors closely watch

the Bank Nifty share price to make trading decisions, as the performance of

this index reflects the strength of the Indian banking sector.

Bank Nifty Today

Today’s market shows a robust performance in Bank Nifty,

reflecting the overall optimism in the banking sector. For real-time data,

traders can access Bank Nifty today live charts and monitor price movements.

Live tracking enables traders to make informed decisions based on the current

market conditions.

Bank Nifty Chart

Bank Nifty chart analysis is essential for understanding

historical data and making predictions for future movements. Many traders use

technical analysis tools like support and resistance levels, moving averages,

and candlestick patterns to predict Bank Nifty’s future performance. By

analyzing the Bank Nifty live chart, traders can better time their entries and

exits to maximize profits.

Bank Nifty Option

Chain

Options trading in Bank Nifty is highly popular among

traders looking for high volatility and profit potential. The Bank Nifty option

chain provides detailed information about the calls and puts for a given expiry

date. Traders use this data to gauge market sentiment and make short-term

trading decisions. On Bank Nifty expiry day, volatility often spikes, offering

traders opportunities to profit from price swings.

Bank Nifty Expiry

The Bank Nifty expiry date, typically on Thursdays, plays a

significant role in options trading. High volatility is seen on expiry day, as

many traders close their positions. Understanding how options behave as they

approach expiry is essential for profiting from this index. Traders should

always have an expiry strategy in place to manage risks effectively.

Bank Nifty Prediction

For those looking for the Bank Nifty today prediction, it is

essential to analyze various factors such as global market trends, interest

rates, and economic data. Many traders rely on technical indicators and Bank

Nifty charts to forecast movements. However, predictions should be cautiously

approached, as market conditions can change rapidly.

Factors Influencing

Bank Nifty

Several factors influence the movement of the Bank Nifty

share price, including:

1.

Interest

Rates: Changes in RBI interest rates directly affect banking stocks.

2.

Economic

Indicators: Inflation rates, GDP data, and economic policies can influence

market sentiment toward the banking sector.

3.

Global

Markets: Global financial markets and foreign investor activity play a

crucial role in determining Bank Nifty’s performance.

4.

Corporate

Earnings: Earnings reports of the 12 banks in Bank Nifty significantly

impact its price movement.

How to Trade Bank

Nifty?

Identify Market Trends: Use technical analysis tools like

moving averages and Bank Nifty charts to identify trends.

1.

Monitor

Live Charts: Keep track of Bank Nifty live charts to stay updated on

real-time price movements.

2.

Analyze

Option Chain: Study the Bank Nifty option chain for calls and puts data

before making a trade.

3.

Prepare

for Expiry: On Bank Nifty expiry day, volatility increases. Having a

strategy to manage risk on expiry day is essential for traders.

4.

Use Risk

Management: Always apply stop-loss orders and follow a disciplined trading

approach.

Bank Nifty Share

Price Analysis

The Bank Nifty share price is impacted by the performance of

the 12 constituent banks. Analyzing price movements through historical data,

candlestick patterns, and technical indicators can help traders predict future

price action. A consistent strategy involving trend analysis and momentum indicators

often yields profitable trades.

Bank Nifty Today Live

Chart

For real-time analysis, traders rely on Bank Nifty today

live charts to observe price fluctuations and make quick decisions. Intraday

traders, in particular, use live charts to track minute-to-minute movements and

catch opportunities within a short time frame.

FAQs about Bank Nifty

Forecast

What is the Bank

Nifty forecast for the next week?

Predicting Bank Nifty involves analyzing both technical and

fundamental factors, including interest rate changes, global market trends, and

key banking sector developments. Traders are advised to use tools like moving

averages and the Bank Nifty chart for better accuracy.

How can I trade Bank

Nifty options?

Trading Bank Nifty options requires understanding the Bank

Nifty option chain and analyzing volatility, strike prices, and expiry dates.

You can start by studying live market data and practicing on a demo account

before risking real capital.

What happens on Bank

Nifty expiry day?

On Bank Nifty expiry day, the volatility tends to increase

as traders close out their positions. This creates rapid price movements, and

traders often see large price swings.

How can I access the

Bank Nifty live chart?

You can access the Bank Nifty live chart through various

trading platforms like Zerodha, Upstox, and the NSE website. Live charts

provide real-time data to help traders make informed decisions.

What factors

influence Bank Nifty prediction?

The main factors influencing Bank Nifty prediction include

RBI monetary policies, corporate earnings of the constituent banks, global

economic trends, and technical indicators like moving averages and candlestick

patterns.

Conclusion

Bank Nifty is a significant index for both traders and

long-term investors. With real-time monitoring using tools like the Bank Nifty

live chart and in-depth analysis of the Bank Nifty option chain, traders can

make informed decisions. Always consider risk management strategies, especially

on Bank Nifty expiry day, to navigate the high volatility associated with this

index. By understanding the fundamentals and applying technical analysis,

traders can succeed in trading this index.

Comments