Is it advisable to invest in USDT for the long-term?

Investing in Tether (USDT) for the long term is not advisable due to several significant risks.

1. Credit Risk

USDT is a stablecoin pegged to the US dollar, but its stability relies on the reserves backing it. If Tether's reserves are not fully backed by US dollars or other high-quality assets, there is a risk of de-pegging, meaning the value of USDT could drop significantly.

2. Regulatory Risk

The regulatory landscape for stablecoins is evolving, and there is a risk of stricter regulations or even bans in the future. This could impact the value of USDT and limit its liquidity.

3. Counterparty Risk

Tether is a privately issued stablecoin, and there is a risk of counterparty default. If Tether's issuer were to become insolvent, it could impact the value of USDT.

4. Lack of Yield

Unlike traditional investments like stocks or bonds, USDT does not offer any yield or interest. This means you are not earning any return on your investment over the long term.

Potential Benefits

- Stability: USDT can provide a stable store of value during times of market volatility.

- Liquidity: USDT is one of the most liquid cryptocurrencies, making it easy to buy and sell.

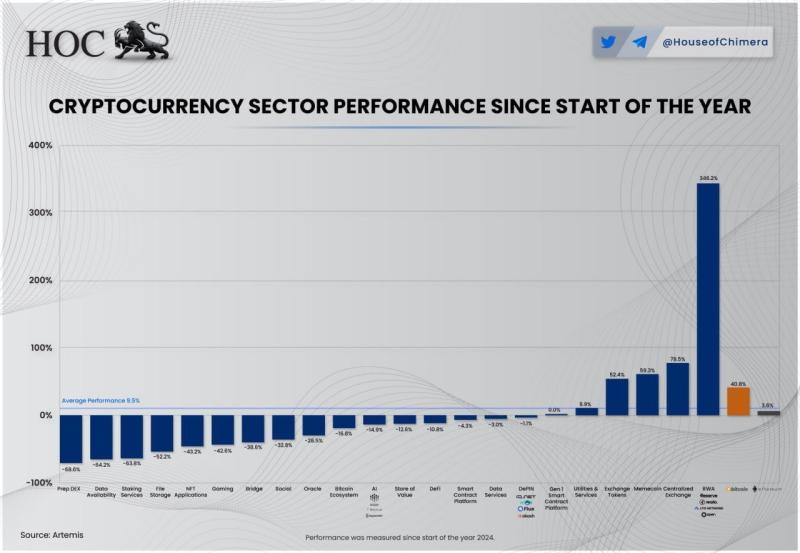

RWA Tokens as an Investing Opportunity

Real-world asset (RWA) tokens are a new asset class that represents ownership of real-world assets like real estate, commodities, or loans. RWA tokens offer the potential for higher returns and diversification benefits compared to traditional investments. However, RWA tokens are also subject to market risk and regulatory uncertainty. It is important to do thorough research and understand the risks before investing in RWA tokens.

Conclusion: While USDT can be a useful tool for short-term trading or hedging against market volatility, it is not advisable for long-term investing due to the significant risks involved. Investors seeking long-term returns should consider other investment options like stocks, bonds, or real estate.

Post Your Ad Here

Comments