Tracking the Live Price of Gold in Canada

The current gold price in Canada.

To make informed portfolio choices, Canadian investors need to keep an eye on the price of gold. It is possible that gaining an understanding of market trends may assist you in optimizing your returns on gold, which is a popular investment due to its consistency and potential for growth. Utilizing online resources makes it simple to monitor the price of gold in Canada. Gold prices are tracked in real-time by several reputable websites:

One of the best services for analysing gold prices in Canada is Kitco.com. Gold spot prices, historical data, and market research are all made available through their user-friendly interface.

This gold price monitoring website, GoldPrice.org, Au Bullion provides current spot prices, charts, and historical data for gold and other precious metals. Additional features include historical data.

In addition to providing live gold price tracking and analysis, prominent financial news sources also provide this service. Use these websites to better understand the elements that influence the gold market.

Gold in Canada: where to buy

Find out how and where you may buy gold in Canada when you have gained a grasp of the price of gold. There are several choices:

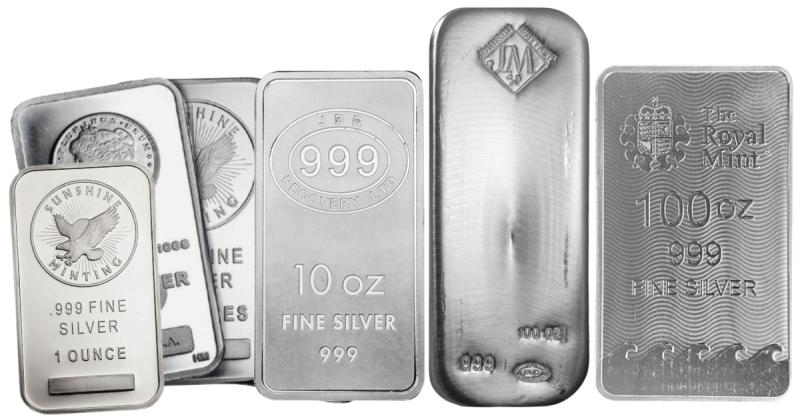

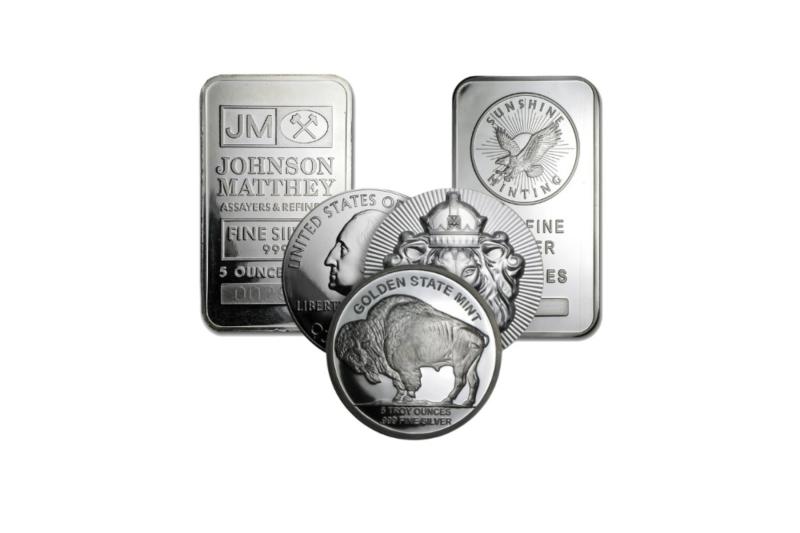

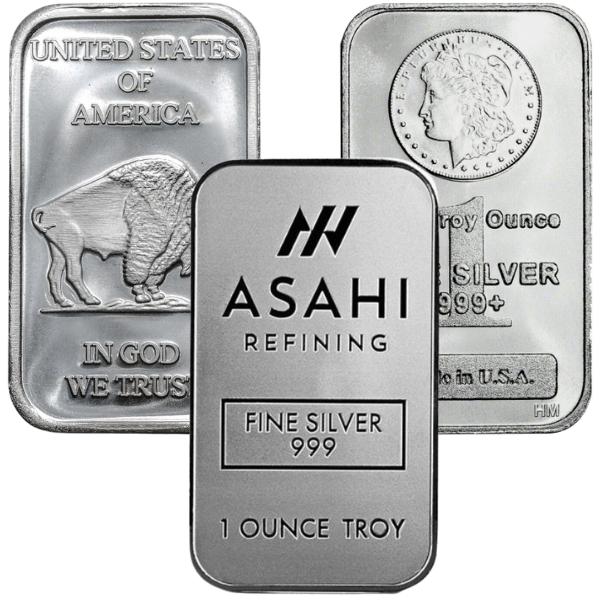

Dealer shops provide a wide selection of gold products, ranging from coins to bars, and may also offer guidance on the many investment options available to you.

Bullion programs for gold are offered by several financial organizations in Canada, including the Royal Bank of Canada and the Bank of Montreal.

Various methods for investing in gold in Canada

There are many options to gold for purchase:

Purchasing real goods in the form of coins or bars is the best of the bunch.

Investing in gold mining stocks might put you in a position where you are indirectly exposed to the gold market. The stock prices of these companies are directly proportional to the value of the metal, that they mine, extract, and manufacture.

Gold futures and options markets provide chances for speculative trading and hedging to investors who have the necessary level of expertise. By purchasing futures, you can speculate on the price of gold without really owning the item.

Comments