Unlock Financial Freedom: How Credit Repair Services Can Boost Your Score

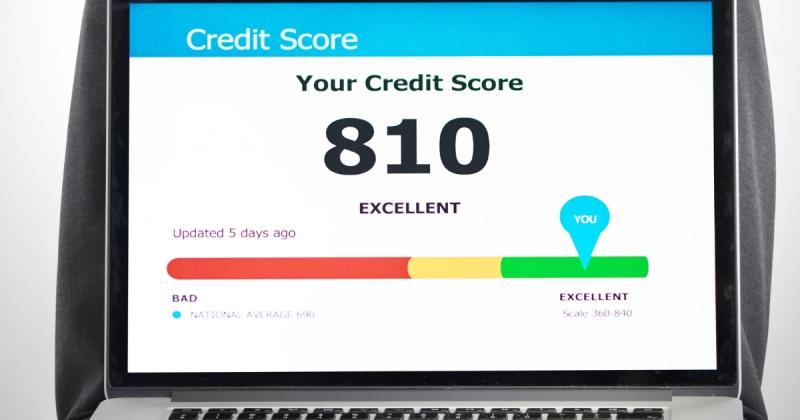

In today’s financial landscape, a healthy credit score is more important than ever. It’s not just about getting approved for a loan or credit card; your credit score influences your ability to buy a home, finance a car, or even secure a rental apartment. In many cases, employers check credit scores to gauge financial responsibility. With such wide-reaching implications, maintaining a strong credit profile is essential. When your credit score takes a hit, professional credit repair services can play a vital role in helping you regain control of your financial future.

What Is Credit Repair?

Credit repair involves addressing issues that are dragging down your credit score, including errors, old debts, or negative marks on your credit report. A credit repair service works to correct these inaccuracies by disputing errors, negotiating with creditors, and guiding you through the process of improving your credit score.

How Credit Repair Services Work

When you sign up for a credit repair service, professionals analyze your credit report in detail. They look for discrepancies like inaccurate payment histories, incorrect account statuses, or duplicate accounts. Many credit reports contain errors that can damage your score without you even knowing it. By identifying these errors, credit repair experts can take action by filing disputes with the credit bureaus on your behalf.

Credit repair services also communicate with creditors to negotiate the removal of negative information, like late payments or charged-off accounts. In some cases, they can set up repayment plans that prevent further damage to your score while helping you settle old debts.

Why Credit Repair Matters

A poor credit score can affect various aspects of your life, from housing to employment opportunities. Here are a few reasons why credit repair is crucial:

Loan Approval: Lenders view a high credit score as a sign of reliability. If your credit score is low, you may struggle to secure a mortgage, car loan, or personal loan.

Lower Interest Rates: A better credit score leads to more favorable interest rates, saving you money in the long run.

Employment Opportunities: Some employers check credit scores during the hiring process, especially for jobs involving financial responsibilities.

Better Rental Options: Landlords often review credit scores when considering rental applications, making it essential to have a strong score if you're looking for housing.

Credit repair can be a game-changer if you find yourself stuck with a score that doesn’t reflect your true financial responsibility. It provides the opportunity to correct mistakes and begin rebuilding your financial reputation.

The Rise of AI Credit Repair

Technology has revolutionized almost every industry, and credit repair is no exception. The introduction of AI credit repair is making it faster and more efficient to improve credit scores. AI-driven systems can analyze your credit report in real-time, identifying errors and areas for improvement much more quickly than a human could. These platforms use algorithms to recommend the best actions, whether it's disputing a specific negative mark or suggesting strategic ways to manage your existing debt.

By utilizing AI, credit repair services can streamline the process, giving consumers faster results. For example, AI credit repair platforms can automate many of the tedious steps like tracking disputes, managing communication with credit bureaus, and staying on top of follow-up tasks. The integration of AI allows for a more personalized approach to repairing credit, as it can adapt to each individual’s unique financial situation.

Can Credit Repair Services Guarantee Success?

It’s important to understand that while credit repair services can significantly boost your credit score, they cannot guarantee instant or total success. The process takes time and depends on various factors, such as the nature of the errors on your credit report and your current financial situation.

However, credit repair services can greatly improve your chances of success by using their expertise and established relationships with creditors and credit bureaus. With the added power of AI, the credit repair process is becoming faster and more reliable, helping people unlock financial freedom more effectively than ever before.

Do-It-Yourself Credit Repair vs. Professional Services

While you can take steps to repair your credit on your own, the process can be time-consuming and complex. Professional credit repair services bring expertise to the table, saving you time and effort. With a team of professionals or AI-backed services handling your disputes and negotiations, you’re more likely to achieve a positive outcome in less time.

That being said, it’s essential to choose a reputable credit repair service. Look for companies with transparent fees, clear communication, and a history of helping clients improve their credit. Avoid services that promise to remove accurate negative information or guarantee specific score improvements, as these can be red flags.

Conclusion

Credit repair services are a powerful tool for anyone looking to regain financial control. Whether you’re recovering from past financial mistakes or trying to correct errors on your credit report, these services can make a significant difference in your overall financial health. With the rise of AI credit repair technology, the process has become even more efficient, enabling faster and more personalized results.

By investing in credit repair, you can unlock financial freedom and open up new opportunities, from securing loans at favorable rates to landing the job of your dreams.